Jamie Burink

- Lending

- Articles

Scale up loan operations with automation

To achieve scalable loan operations, institutions need loan administration automation that combines speed, accuracy and...

Discover more

- Lending

- Articles

Seamless loan administration with real-time API integrations

A connected digital infrastructure improves the borrower experience, strengthens compliance and drives efficiency.

Discover more

- Lending

- Articles

Flexible loan repayment options for borrower-centric servicing

Traditional repayment plans focus on operational control but overlook personal circumstances. By offering adaptable...

Discover more

- Lending

- Articles

Loan disbursement automation: faster, compliant digital payouts

Loan disbursement automation enables lenders to release funds faster, with greater accuracy and full regulatory...

Discover more

- Lending

- Articles

Automated financial reporting for lenders: faster, audit-ready insights

Automated financial reporting software for lenders ensures accuracy, transparency and compliance, giving CFOs and risk...

Discover more

- Lending

- Articles

End-to-end loan servicing automation: disbursements, collections and arrears management

End-to-end loan servicing automation allows lenders to control disbursements, collections and arrears management in one...

Discover more

- Lending

- Articles

All-in-one customer dashboard for loan management

Slow responses undermine trust and efficiency. Without clear access to borrower data, servicing teams spend too much...

Discover more

- Lending

- Articles

Proactive loan monitoring

Maintaining portfolio health requires real‑time insight and structured workflows that enable early, decisive action....

Discover more

- Lending

- Articles

Building connections, empowering Europe

A connected digital infrastructure reduces friction, accelerates decision-making and builds a stronger foundation for...

Discover more

- Lending

- Articles

Protect your data, ensure integrity

A secure data foundation reduces risk, enhances operational efficiency and gives institutions the confidence to scale...

Discover more

- Lending

- Articles

Streamline your ESG reporting

By connecting and standardizing ESG data, institutions can turn compliance challenges into strategic opportunities that...

Discover more

- Lending

- Articles

Seamless data integration made simple

With a unified approach to data integration, lenders can reduce complexity and ensure that critical information is...

Discover more

- Lending

- News

Fyndoo is now Akkuro Lending

Akkuro Lending builds on the proven foundation of Fyndoo. From origination and underwriting to monitoring and portfolio...

Discover more/Manage%20-%20loan%20management.jpg)

- Lending

- Articles

Smarter loan management for in-life servicing

Rigid systems and manual processes often slow down even basic updates. Teams spend time on administrative tasks instead...

Discover more

- Lending

- Articles

Seamless implementation of financial spreading software

That’s exactly what Akkuro Lending delivers. From system setup to training and go-live, we help institutions move from...

Discover more

- Lending

- Articles

Integrate financial spreading software with current systems

That is why seamless integration between your financial spreading software and core systems is essential. With...

Discover more

- Lending

- Articles

Akkuro Lending vs. Excel: why modern financial spreading wins

Akkuro Lending offers a secure, scalable and automated alternative to Excel - purpose-built for modern lending...

Discover more

- Lending

- Articles

Financial spreading for annual statements

Balance sheets, income statements and cash flows should be a source of clarity, not complexity. That’s why modern...

Discover more

- Lending

- Articles

Automated financial spreading for smarter decisions

Manual tools like spreadsheets weren’t designed for today’s speed, complexity or compliance demands. As data volumes...

Discover more

- Lending

- Articles

What is financial spreading?

By automating the extraction, standardization and analysis of financial data, financial spreading transforms raw...

Discover more

- Lending

- Articles

Customizable loan origination

Modern lending moves fast. But no two institutions operate the same way. Whether you're scaling real estate credit or...

Discover more

- Lending

- Articles

What is loan origination?

Loan origination covers every step from the initial application to final disbursement. It’s where institutions validate...

Discover more

- Lending

- Articles

Transform how you originate loans

Outdated lending processes are taking a measurable toll. Time-to-Yes frequently exceeds five days, dragging out the...

Discover more

- Lending

- Articles

Closing the global MSME funding gap

Many MSMEs operate in a grey zone between consumer credit and corporate finance. They often lack tax records, credit...

Discover more

- Lending

- Articles

Automated loan origination

When approval processes take too long or feel fragmented, borrowers drop off and teams lose valuable time. Whether it’s...

Discover more

- Lending

- Articles

Traditional systems vs. modern origination

Loan origination is a core process, but too often it’s anchored in outdated technology. The result? Approval times...

Discover more.jpg)

- Lending

- White Papers

Digitization of loan origination

Loan origination is at a turning point. Many financial institutions still rely on outdated legacy systems and manual...

Discover more

- Lending

- White Papers

Optimize your loan conversion

Traditional lending models often fall short, with disjointed processes, legacy tech, and limited personalization...

Discover more

- Lending

- White Papers

Top 5 technology trends for lenders in 2025

Discover how five powerful technology trends are reshaping the future of lending, enabling banks and financial...

Discover more

- Lending

- Playbooks

The invisible lending playbook

Lending no longer begins at the bank. As credit becomes embedded into digital ecosystems, financial institutions face a...

Discover more

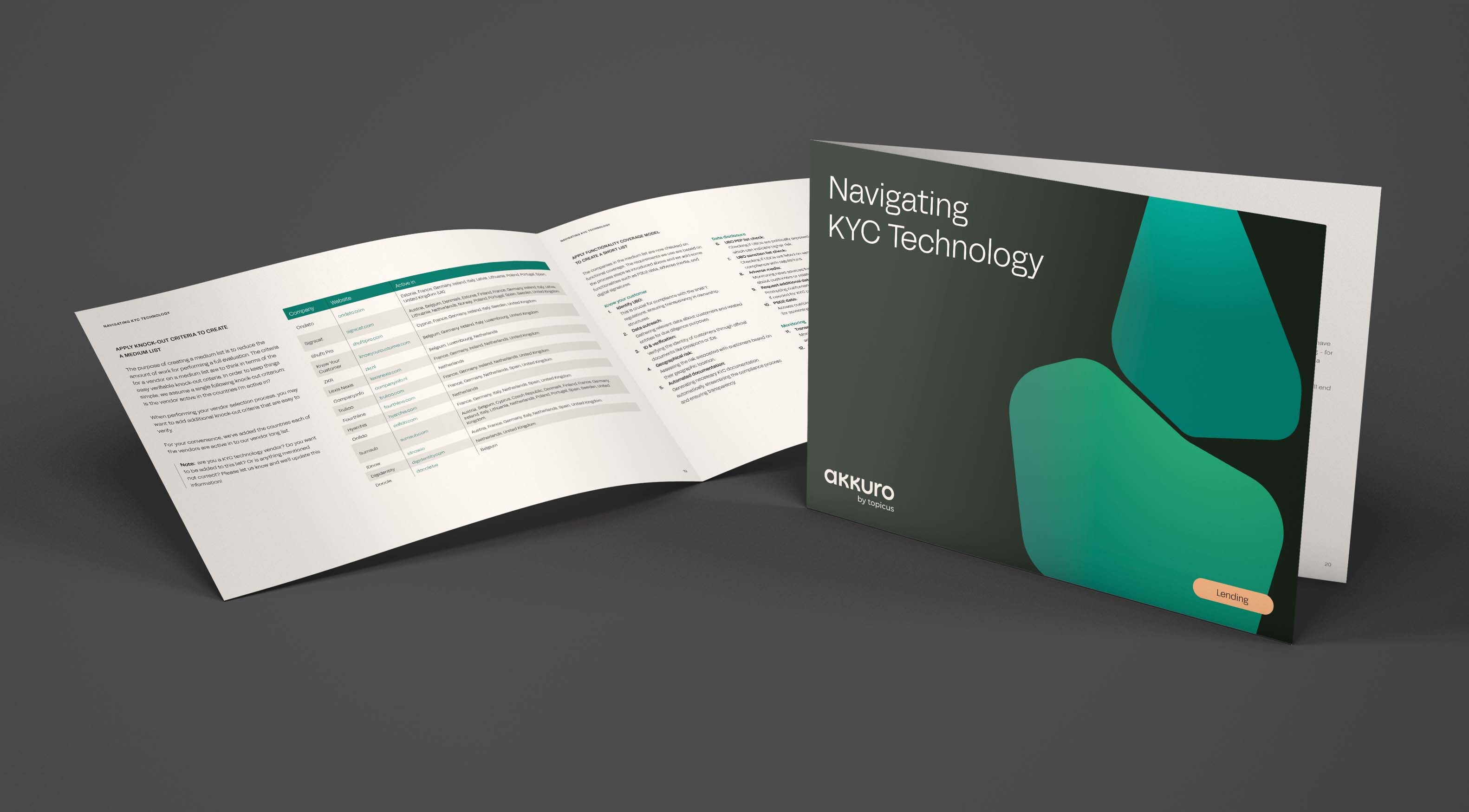

- Lending

- Playbooks

Navigating KYC technology

Explore how modern KYC technology helps financial institutions streamline AML compliance, strengthen CDD processes,...

Discover more

- Lending

- Playbooks

Revolutionizing SME lending

The SME lending landscape is rapidly evolving, and staying competitive requires embracing innovation and collaboration....

Discover more

- Lending

- Articles

Assessing creditworthiness with GLOM compliance

See how GLOM guidelines empower financial institutions to enhance credit assessments, reduce risk, and drive smarter...

Discover more

- Lending

- Checklists

The digital origination checklist

Explore how the "Digital Origination" checklist helps financial institutions modernize loan processes, boost...

Discover more

- Lending

- Playbooks

The impact lending playbook

SMEs make up over 50% of global employment and economic activity, yet many remain financially underserved. Limited...

Discover more

- Lending

- Guides

Lending Implementation Guide

Learn how the Akkuro Lending Implementation Guide streamlines platform deployment with a structured, 100-day approach...

Discover more